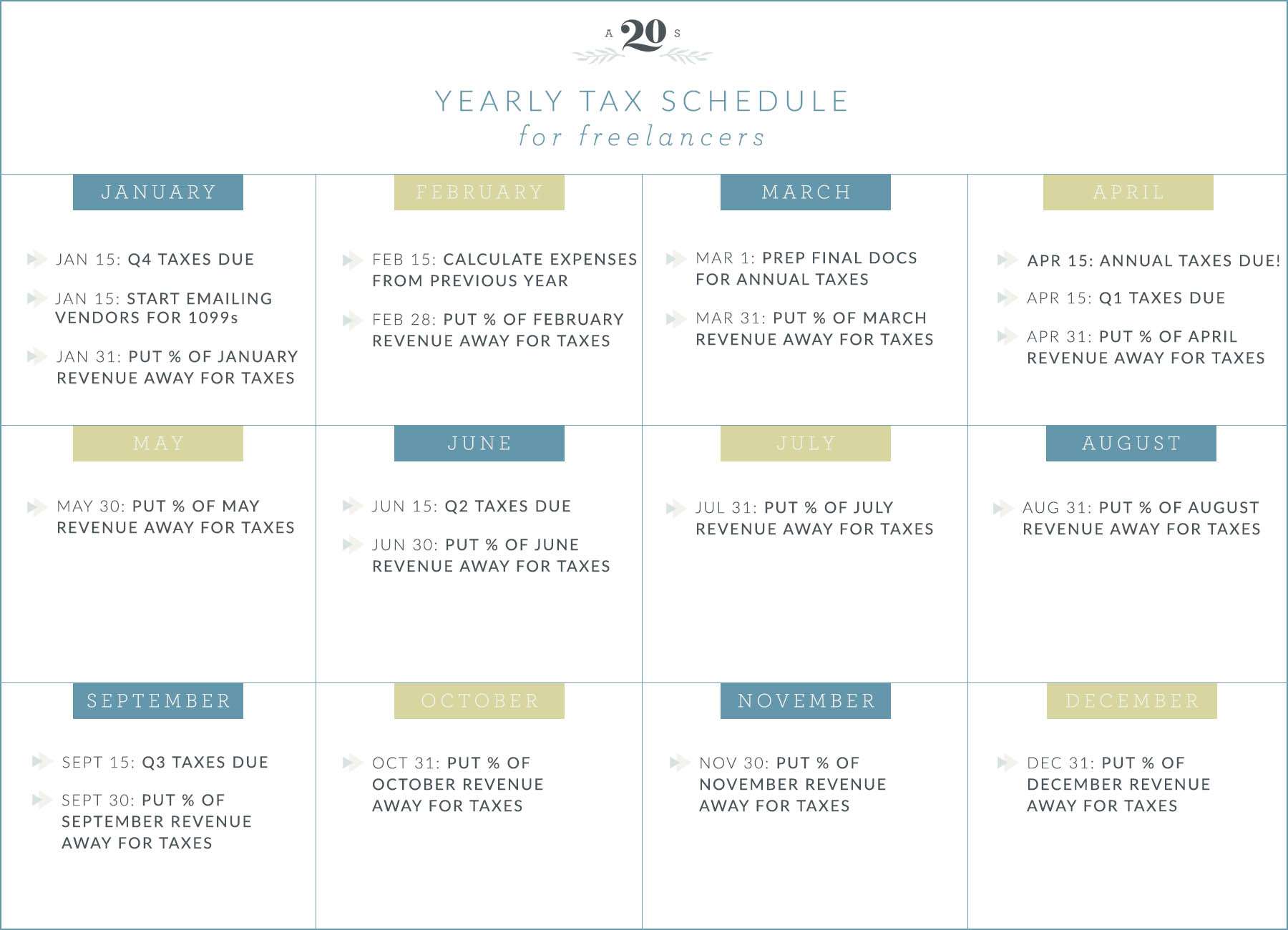

As soon as tax season is over, it’s common to want to forget about them until the next season rolls around. But as a freelancer, it’s important to pay attention to your taxes throughout the year. To avoid the stresses that come leading up to April 15th, there is plenty you can do year round to make your life easier. But instead of just listing them out for you, I thought I’d make a simple calendar you can refer to each month for a little guidance.

Pay Your Taxes Quarterly

The biggest issue us freelancers face is having to owe a huge sum by the end of the year. If you work for an employer, your taxes are taken out of your paycheck automatically, so you typically don’t owe anything come April 15th. It’s definitely a different story for us! The most useful thing I started doing is paying my taxes quarterly. It really helped take the stress off! To calculate how much to pay each quarter, start by estimating your income for that year. If you think you’ll grow significantly from the year before, take that into account.

In order to calculate that amount accurately, and make sure you have the correct forms to submit with those payments, I like to use TurboTax SmartLook so I can talk to an expert. TurboTax Self-Employed gives you priority access to credential tax advisors. You can connect live via one-way video to CPAs or Enrolled Agents and get answers immediately at no additional cost. You can schedule an appointment if that works better for you! It’s definitely my favorite tool that TurboTax Self-Employed has to offer!

Put Aside Money Each Month for Taxes

The other dates you’ll notice on the calendar is the last day of each month. While paying your taxes quarterly is great advice, it can still be difficult to scrape up that amount of money every three months. This year I’ve decided to review my income on a monthly basis and set aside a specific amount to go towards my quarterly tax payments.

To keep track of my revenue, I use Quickbooks Self-Employed and I don’t know what I’d do without it! I link up my bank accounts, credit cards, and more to my Quickbooks Self-Employed account, allowing me to keep track of all of my payments. I also create invoices not just for my clients, but for myself! At the end of each month, it’s so easy to log in and see exactly what I earned that month and even subtract my expenses as well.

Prep for Annual Taxes

I’ve also included a few arbitrary dates towards the beginning of the year to help you prep for your annual taxes. I always suggest getting on top of your vendors for 1099s as early as possible. Technically, they are required to submit their 1099 forms by January 31, so emailing them mid-January is a good idea. Ideally, they’ll just send you your 1099 form, but every once in a while there are vendors who don’t. So rather than waiting on them, take the initiative! I added a couple more dates for you to start calculating your expenses and prepping the rest of your docs.

Thank you Quickbooks Self-Employed for sponsoring this post!

Using Trunk Club to Update My Spring/Summer Wardrobe

Using Trunk Club to Update My Spring/Summer Wardrobe 5 Tips For Styling a Simple Summer Dress

5 Tips For Styling a Simple Summer Dress 5 Ways to Style a Bandana

5 Ways to Style a Bandana 3 Different Ways to Curl Your Hair

3 Different Ways to Curl Your Hair How to Master the 5-Minute Makeup Routine

How to Master the 5-Minute Makeup Routine Amazon Beauty Buys Under $25

Amazon Beauty Buys Under $25 3 Ways to Make Your next Trip More Memorable

3 Ways to Make Your next Trip More Memorable Tips for Digital Spring Cleaning and Organizing

Tips for Digital Spring Cleaning and Organizing Color Trend: Marigold

Color Trend: Marigold Mental Health Update: The 3 Major Changes I Made to Get Out of Depression

Mental Health Update: The 3 Major Changes I Made to Get Out of Depression 5 Unexpected Ways to Unwind After Work

5 Unexpected Ways to Unwind After Work How to Know You’re in a Controlling Relationship

How to Know You’re in a Controlling Relationship 4 Questions I get Asked as a Professional Resume Writer

4 Questions I get Asked as a Professional Resume Writer How to Make Friends at Work

How to Make Friends at Work Getting Out of the ‘Busy’ Mindset

Getting Out of the ‘Busy’ Mindset Ask Amanda: How do I pursue the career I want without formal training?

Ask Amanda: How do I pursue the career I want without formal training? Ask Amanda: How Do I Find a Therapist?

Ask Amanda: How Do I Find a Therapist? Ask Amanda: How do I stop being jealous in my relationship?

Ask Amanda: How do I stop being jealous in my relationship?

Ashley Kane Says

Oh boy, did this come at a fortuitous time. :) Just finished my taxes this year and OOF! I just went ahead and saved your chart. Thank youuuuu!

Pingback: On Our Radar. - Pretty & Fun

Mery Wilmertt Says

The yearly tax schedule as a freelancer can be a maze, but it’s crucial to stay on top of it. Personally, I’ve found that meticulous record-keeping is a game-changer. Ensure you’ve got all your documents in order – it’s the key to a smooth tax season. Speaking of which, online tools like PDFLiner can be a lifesaver. They not only streamline the process but also provide valuable insights. I recently stumbled upon their blog about correcting W-2 form errors here and it was incredibly useful.