With two years of full-time blogging under my belt, I would hope that I’d have some tax tips for you. Luckily, this past year was a serious learning experience for me. Last year’s tax filing really kicked my butt, so I made it a priority to be well-prepared for this coming tax season. Though I’m certainly no expert, and could still use a lot of help, I’ve finally discovered some helpful tax tips for bloggers that you may want to take a look at!

1. Create a separate bank account.

Setting up a separate bank account and credit card for my business was the best thing I ever did. It made it so much easier to track my income & expenses, and helped keep things separate in my head. I could see how my business was doing without getting everything mixed up with my personal finances. For the clients that pay via direct deposit, that revenue can go straight into your business checking account. And you can use your business credit card for all of your expenses, which will make them so much easier to add up come tax season.

2. Track income with Quickbooks Self-Employed.

The other best thing I did for my business last year was create an account with Quickbooks Self-Employed. Oh my god, you guys. Why did it take me so long to discover this?? You can link all of your bank accounts (even Paypal!) to Quickbooks Self-Employed, create & send invoices, track income & expenses, and so much more. I first signed up to help me track my income in a more organized way.

As a blogger, you know that some clients pay you after 60 days via a check while others may pay 30 days out via direct deposit. Basically, it’s so hard to keep track of your income! I now create an invoice every time I get a new campaign and can then link that invoice to my payments so I’m always on top my revenue. It’s also super helpful to see how many campaigns came from certain agencies or just to see a full list of who I worked with in a certain quarter, etc.

3. Track expenses with Quickbooks Self-Employed.

Expenses are a whole other story. First of all, it’s helpful to understand why tracking your expenses is so important. Business expenses are tax deductible. What does that mean? It means that you can subtract the total amount you spent on expenses from your total income. This may put you in a lower tax bracket, which would decrease your tax rate. So if you made $100,000, and your expenses totaled $20,000, you would go from paying a 28% tax rate to a 25% tax rate. In the end, this will lower the amount you owe.

What can you expense? Anything that you spent money on that was entirely for your business is considered an expense. Examples include camera equipment, photo shoot props, marketing & advertising, etc. If you work from home, you can also include a percentage of your rent & utilities, but not the entire amount. With my separate business account & credit card, it’s now much easier to track my expenses. What makes it even easier is linking those accounts to Quickbooks Self-Employed. You can categorize expenses in real time, and customize recurring expenses so it automatically recognizes them as they come in. When tax season comes around, it’s so much easier to see the exact, total amount I spent in expenses by category that year.

4. Take a percentage out of each payment to save for taxes.

I’ll admit, this is something I did not do last year and I regret it. As bloggers (or any freelancer), when we get paid, our clients don’t take out a percentage for taxes like they would at a large company. If you want to make sure you’re prepared to pay your taxes, I highly recommend taking out a percentage of every payment you receive and putting it away for taxes. I also recommend paying your taxes quarterly with that amount you have saved away so that you’re not stuck at the end of the year paying a big lump sum. If you know what you made last year, just check online to see what tax bracket that falls in and use that percentage.

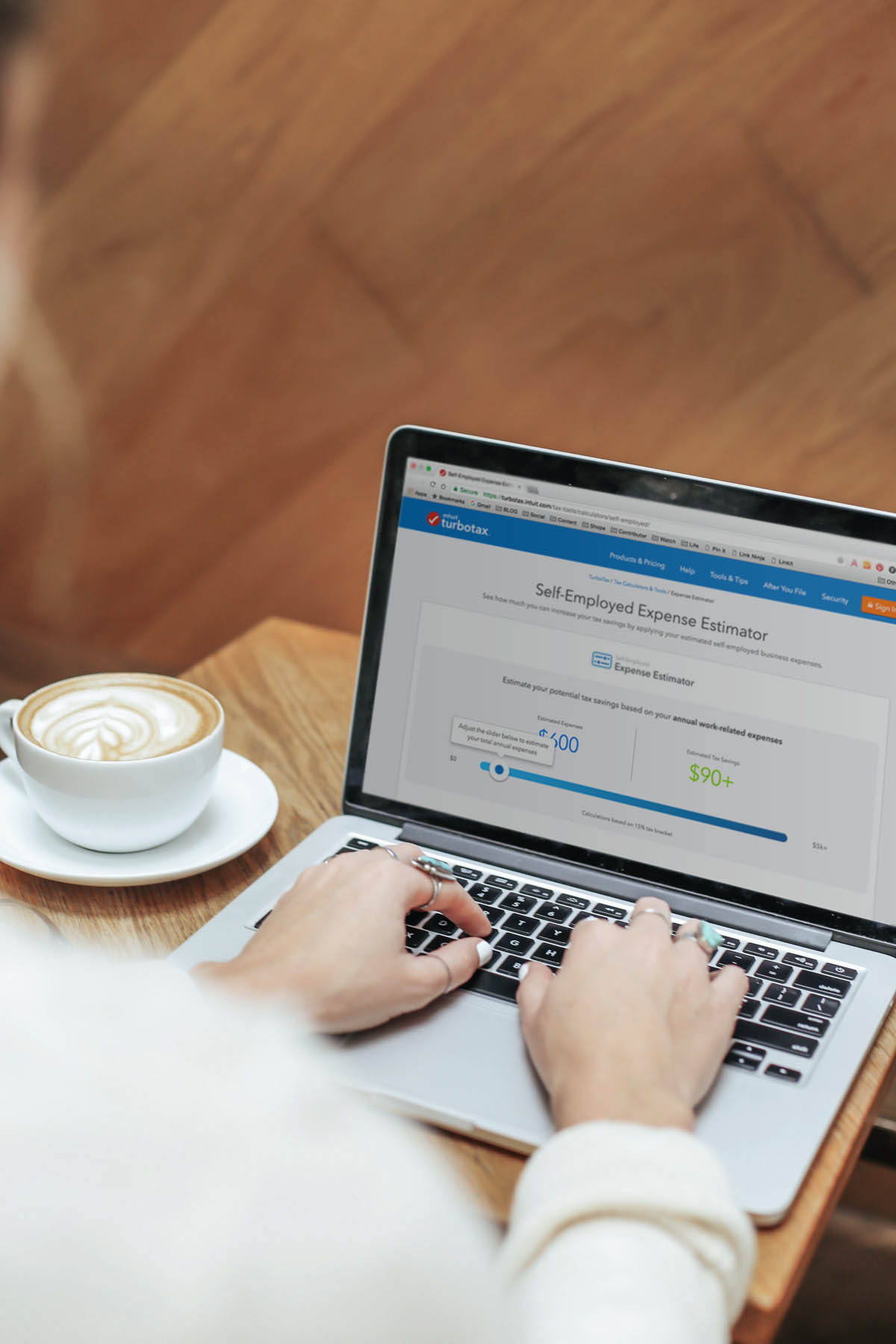

5. File taxes with TurboTax Self-Employed.

Because we are self-employed, spending a ton of money on an accountant isn’t always realistic. I’m in love with TurboTax Self-Employed because it’s affordable and crazy easy to use! Even better, if you use Quickbooks Self-Employed, you’re able to connect your account to TurboTax, making tax filing even easier. Besides asking super simple questions to help you do your taxes, TurboTax Self-Employed also tells you what forms you need and even provides them for you. And since expenses can be hard to decipher, TurboTax also makes it easy to figure out what you can expense through their Expense Finder Tool. Best of all, if you have questions, you can literally talk to a professional via video chat with their SmartLook Tool! So instead of searching through tons of questions in a help center, you can get personalized advice from an actual human being. Pretty amazing right?

So if you’re a blogger or any other type of freelancer, definitely consider using these super helpful tools and tips when you file this year. You can also check out last year’s post with some more basic tips!

Thank you TurboTax for sponsoring this post!

Using Trunk Club to Update My Spring/Summer Wardrobe

Using Trunk Club to Update My Spring/Summer Wardrobe 5 Tips For Styling a Simple Summer Dress

5 Tips For Styling a Simple Summer Dress 5 Ways to Style a Bandana

5 Ways to Style a Bandana 3 Different Ways to Curl Your Hair

3 Different Ways to Curl Your Hair How to Master the 5-Minute Makeup Routine

How to Master the 5-Minute Makeup Routine Amazon Beauty Buys Under $25

Amazon Beauty Buys Under $25 3 Ways to Make Your next Trip More Memorable

3 Ways to Make Your next Trip More Memorable Tips for Digital Spring Cleaning and Organizing

Tips for Digital Spring Cleaning and Organizing Color Trend: Marigold

Color Trend: Marigold Mental Health Update: The 3 Major Changes I Made to Get Out of Depression

Mental Health Update: The 3 Major Changes I Made to Get Out of Depression 5 Unexpected Ways to Unwind After Work

5 Unexpected Ways to Unwind After Work How to Know You’re in a Controlling Relationship

How to Know You’re in a Controlling Relationship 4 Questions I get Asked as a Professional Resume Writer

4 Questions I get Asked as a Professional Resume Writer How to Make Friends at Work

How to Make Friends at Work Getting Out of the ‘Busy’ Mindset

Getting Out of the ‘Busy’ Mindset Ask Amanda: How do I pursue the career I want without formal training?

Ask Amanda: How do I pursue the career I want without formal training? Ask Amanda: How Do I Find a Therapist?

Ask Amanda: How Do I Find a Therapist? Ask Amanda: How do I stop being jealous in my relationship?

Ask Amanda: How do I stop being jealous in my relationship?

Sophie Says

This was super helpful.

http://goldclutter.blogspot.com

Pingback: On Our Radar. - Pretty & Fun

Rahul Tyagi Says

Hey Amanda,

Thanks for these amazing tips. keep it up the great work