How Changing My Definition of Success Improved My Life

posted on February 21, 2017 | by Amanda Holstein

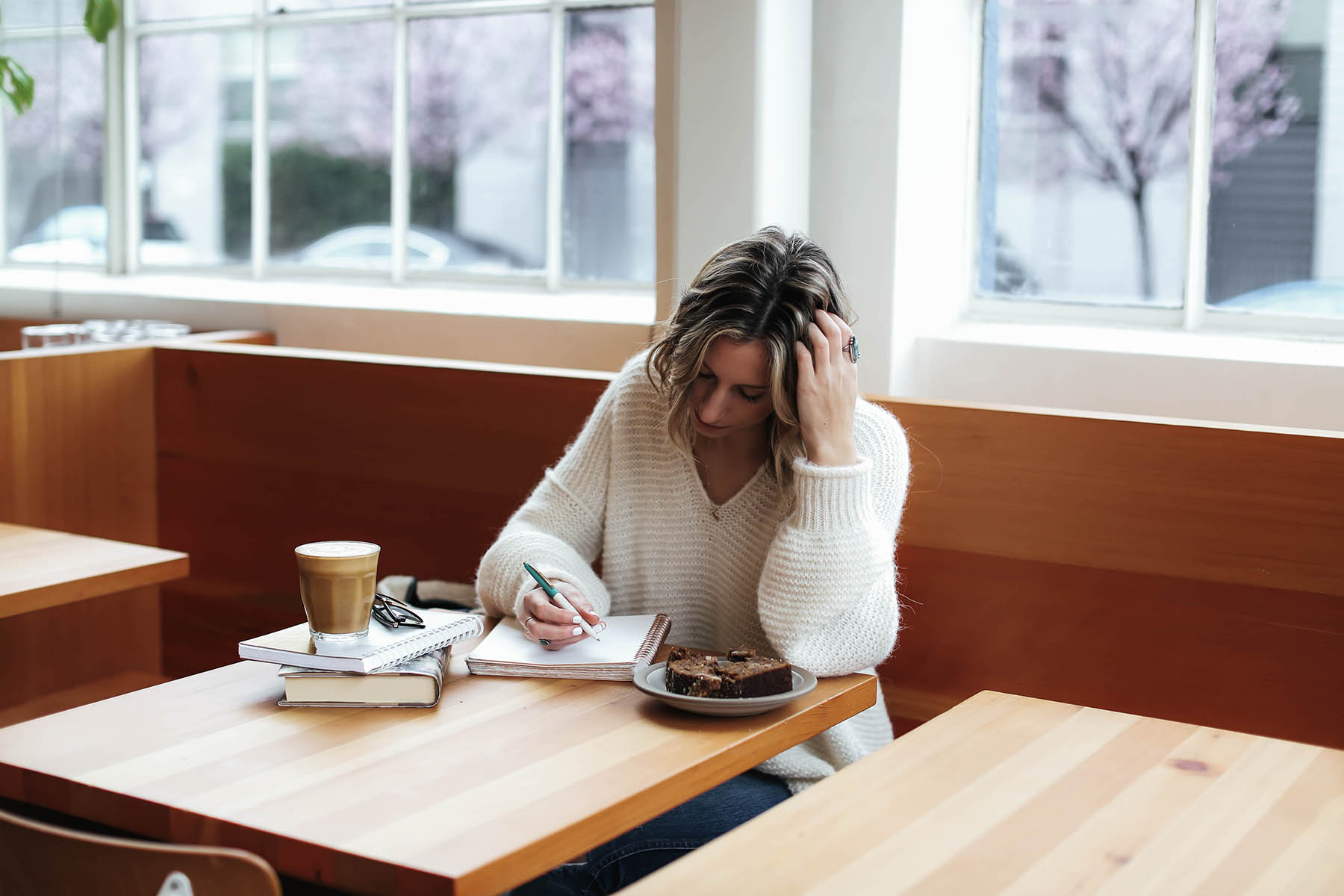

As I navigate my twenties and begin piecing together who I want to be and what is most important to me in life, I’ve noticed how closely I associate my career success with my self-worth. Logically, I know that the former does not define the latter. But being able to truly separate the two is a constant struggle. It wasn’t until my recent session with a Money Coach at the Capital One Café downtown that I realized what was causing this limiting belief: my definition of success.

Money Coaches are sort of like life coaches. They don’t offer you specific financial advice, but they do help you change the way you think about money, clarify your priorities in life, and put those new beliefs into action. It’s actually quite powerful. Plus, anyone—customers or non-customers of Capital One–can meet with a Money Coach at the many Capital One Cafés opening up around the country. After visiting the San Francisco stop of Capital One’s Banking Reimagined Tour, a two-day interactive trailer experience open to the public focused on empowering people to feel confident about their relationship with their money, I had the opportunity to sit down with a Capital One Money Coach to get my own personal coaching session. I was told Money Coaching is kind of like life coaching for your finances – coaches help people visualize their ideal financial situation, identify goals and build a roadmap to achieve them. My session was incredibly insightful (even life-changing!) that I couldn’t help but share the experience with you and hopefully make you question your definition of success as well.

Step 1: Define your present situation & think about your future.

The first task I was given in our session was to look at my current situation and ask myself (1) how I feel about my life and finances, (2) what I spend most of my time doing, and (3) what I have in my life right now. For example, I wrote down that I feel content, unsure, satisfied, and anxious. Yes, some of those contradict, but they are very real emotions that I feel often about my life. I spend most of my time building my business, spending time with my boyfriend, and being outside. As for what I have, examples might include a home, a car, investments, children, etc. I wrote down an amazing relationship and a supportive family.

Try it for yourself! Once you’ve written down how you view your present situation, ask yourself how you’d like to feel about your life and your finances in the future, what you’d like to spend your time doing in the future, and what you hope to have in the future. (Your future meaning 5ish years from now). Identifying your current state and creating tangible future goals can be extremely enlightening and help give you a clear direction.

Step 2: Write down what beliefs you have about money.

There were a few exercises to choose from after Step 1, but I went with one that made me come to terms with my limiting beliefs about money. My Money Coach asked me questions that helped me define what those limiting beliefs were. Examples include things like, “The more money you have, the more capable you are to succeed,” or, “People shouldn’t talk about money,” or, “If you’re smarter, you’ll make more money.” Any thoughts or assumptions you have about money, whether you think they’re good or bad, write them down. You might be surprised once you see those beliefs on paper.

Step 3: Focus on one of those beliefs and write down how it makes you act & feel.

The one that struck me the most was a belief I’ve had my whole life: The older you get, the more money you should make. When I said those words out loud, I realized just how limiting that belief was. It meant I was putting so much pressure on myself to earn more money every year. It also meant that I was defining my personal growth by my financial growth, something I really didn’t want to believe to be true.

After selecting this belief to focus on, we then wrote down what actions I take as a result of this belief. For me, that includes pushing myself harder, putting work first, sacrificing workouts or healthy meals to work, and missing out on building close friendships. That’s a lot of things to be putting work in front of! Then I wrote down how that belief makes me feel. Stressed, exhausted, guilty, and anxious were just some of the emotions I wrote down. Seeing how damaging this one assumption about money was on my daily life was eye-opening.

Step 4: Write down what you’d rather feel, do, and believe.

Finally, my Money Coach has me write down how I’d prefer to feel on a day-to-day basis. Rather than stressed and anxious, I’d much rather prefer to feel content and well-balanced. Most importantly, I’d like to be truly confident in myself, trusting in my capabilities instead of relying on external circumstances (like career status or salary) to confirm them for me.

Then we talked about what I would do if I felt this way every day. In contrast to Step 3, my time would be better balanced so that work didn’t take over my life. I would prioritize things I enjoy, like Pilates, hiking, laughing with my boyfriend, and learning new hobbies (like weaving!). In turn, I would be able to enjoy these things without thinking about work. In turn, I would actually be more productive when I did work because I wouldn’t be spread so thin.

Finally, I had to answer this question: What do you need to believe in order to act & feel this way? That’s when I realized it all had to do with my definition of success. I decided, instead of defining “success” by my career and financial status, I would broaden my definition. Success, to me, is being truly happy. It’s living a well-balanced life, where I prioritize what makes me happy and allow my authentic self to thrive.

What I learned from this experience was invaluable: We tend to think that in order to feel happy, we need to do this or have that. But the reality is, true happiness comes from within. Prioritize your internal well-being, and the external things will fall into place.

Thank you to Capital One for sponsoring this post.

Using Trunk Club to Update My Spring/Summer Wardrobe

Using Trunk Club to Update My Spring/Summer Wardrobe 5 Tips For Styling a Simple Summer Dress

5 Tips For Styling a Simple Summer Dress 5 Ways to Style a Bandana

5 Ways to Style a Bandana 3 Different Ways to Curl Your Hair

3 Different Ways to Curl Your Hair How to Master the 5-Minute Makeup Routine

How to Master the 5-Minute Makeup Routine Amazon Beauty Buys Under $25

Amazon Beauty Buys Under $25 3 Ways to Make Your next Trip More Memorable

3 Ways to Make Your next Trip More Memorable Tips for Digital Spring Cleaning and Organizing

Tips for Digital Spring Cleaning and Organizing Color Trend: Marigold

Color Trend: Marigold Mental Health Update: The 3 Major Changes I Made to Get Out of Depression

Mental Health Update: The 3 Major Changes I Made to Get Out of Depression 5 Unexpected Ways to Unwind After Work

5 Unexpected Ways to Unwind After Work How to Know You’re in a Controlling Relationship

How to Know You’re in a Controlling Relationship 4 Questions I get Asked as a Professional Resume Writer

4 Questions I get Asked as a Professional Resume Writer How to Make Friends at Work

How to Make Friends at Work Getting Out of the ‘Busy’ Mindset

Getting Out of the ‘Busy’ Mindset Ask Amanda: How do I pursue the career I want without formal training?

Ask Amanda: How do I pursue the career I want without formal training? Ask Amanda: How Do I Find a Therapist?

Ask Amanda: How Do I Find a Therapist? Ask Amanda: How do I stop being jealous in my relationship?

Ask Amanda: How do I stop being jealous in my relationship?

Allison Says

I love everything about this post. What a great exercise for everybody to walk through. Your thought process is really similar to mine and I know that I could really benefit from a session like this. Although I know I could do it on my own, sometimes having a coach or just someone else there to bounce ideas off of is immensely helpful.

Elizabeth Mayberry Says

I loved this post! So encouraging! Thanks for sharing! I really need to walk through a process like this!

muna Says

That is well delivered and I hope you have all the best in life. In addition to this, i truly believe that sucess is kind of personal and yes happiness is from within, not from outside noise. My question is, is it true that the older you get, the more money you make?

what made you think that you should work harder to earn more?

Thanks in advance

Madeline Says

Such a helpful and insightful post. Thanks so much for sharing!

On a totally unrelated side note- where is the beautiful white sweater from? Kept noticing it in the photos. Thanks!

Amanda Holstein Says

Post authorIt’s from Free People! It’s no longer available, but I like this one even better!