Everything You Need to Know About Paying Back Student Loans

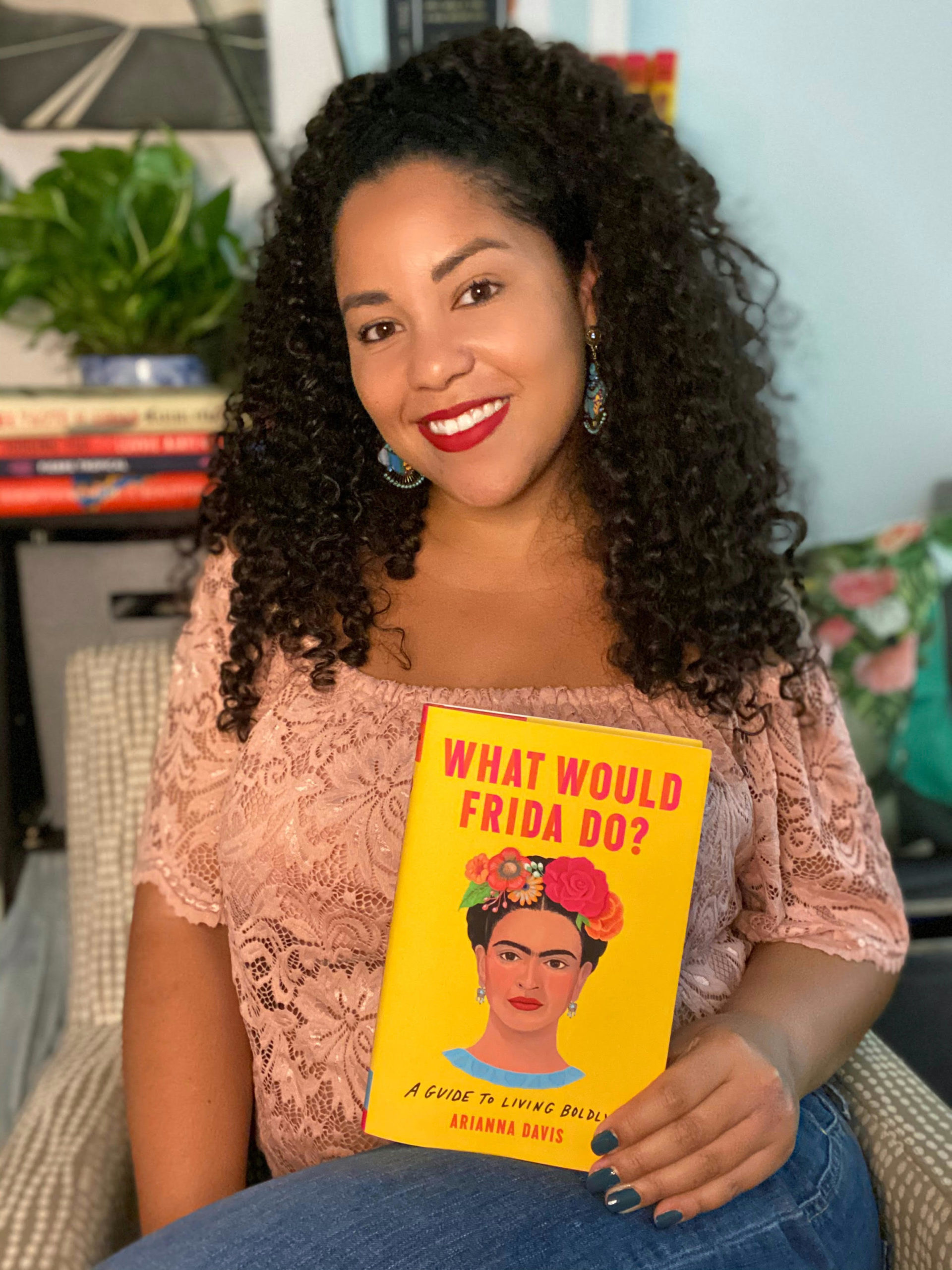

posted on June 12, 2019 | by Ariana Pena

Ah, student loans. The bane of my post-grad existence (if you don’t know who Sallie Mae is, consider yourself lucky). Learning when and how to begin paying back my student loans was an entirely new challenge for me. If this is something you’ve been worrying about, don’t panic! The process is a lot easier than it seems.

When to start paying back loans

If you are unaware of how repayment for student loans work, here’s a quick breakdown: Depending on your loan provider, you will be granted a six-month grace period after your graduation date in which you are not required to make payments on your student loans.

On some of your loans, you will be responsible for paying back the interest that accrued during your enrollment and during the six-month grace period. This is typically the case for Direct Unsubsidized Federal Loans. With other loans (like a Direct Federal Subsidized Loan), the government will pay for the interest that accrues while you are in school and while your loan is in its grace period. Once you’ve reached the six-month mark, your loan provider will bill you for your first student loan payment. From there, your term of repayment begins.

Remember, you do not have to wait until your grace period ends to begin making payments on a loan. In fact, it can actually be really helpful to get ahead on the planning!

How to start paying off loans and who to make payments to

There are a few different ways to figure out how much you owe and how many different loan providers you have.

Often times, loan providers will send you an email or a letter prior to your graduation with the details on your loan account. This will usually include important information on the loan amount, interest rates, when the first payment must be made, and repayment plan options.

It’s best to store these letters or reminders all in one place so you can keep track of how many providers you owe (I keep track of mine using Google sheets, but Excel works, too). You can also download an app like Credit Karma which will break down the total costs that you owe for each provider you’ve taken loans out with (this helped me out soooo much).

Once you’ve figured out who your loans are serviced by, I recommend creating an online account for each provider and establishing a budget for each loan BEFORE your grace periods ends. Learning how to manage your money and creating a budget for your student loans can help to determine the best repayment plan by giving you an idea as to how much you can afford to pay each month. Once you’ve determined the monthly amount you can afford, make sure to set up automated payments to avoid late fees or defaulting on your loan. Remember, you can always pay more than the minimum amount required, which could help you get ahead of interest in the long run.

What to do if you can’t pay back your loans

If you are unable to begin making payments on your loans after the grace period has ended, or if you are no longer able to make payments at any point during the life of your repayment term, there are a few options to consider.

1. Consider changing the due date on your loan. If you are receiving a consist paycheck, you can opt to change the payment of your loan each month to sync up with the days you get paid. This can be really helpful in ensuring you have enough funds in your bank account when your student loan payment hits your account (if you are set up for direct deposit) or easing anxiety about not having enough money to make a payment.

2. If changing the date on your loans doesn’t help, you can consider requesting a forbearance on your payments (not to be confused with deferment! You can read up on the differences between the two here). If your loan is in forbearance, you will not be required to make payments during the requested amount of time, but interest will continue to accrue on the loan. If you have multiple loan providers, you’ll have to submit different requests for each one. Providers typically allow for postponements anywhere from six months to three years and may or may not require additional documentation to support your reasons for choosing to postpone your payments. If you choose this option, keep in mind that the accrued interest gets added on to the principal balance of your loan once you are no longer in forbearance, so it may not be the best long-term solution.

3. You may also consider changing your repayment plan. If you do not choose a repayment plan before the grace period on your loan ends, you are automatically enrolled in a standard 10-year plan. This can often result in higher monthly payments to ensure your loan is paid off within the 10-year period. You can often lower monthly payments by extending the length of your repayment term or by selecting an income-driven or graduated repayment plan (more info on that here).

4. Finally, you can consider consolidation. Consolidating loans essentially means that you can combine multiple federal loans together to create one overall monthly payment. This can help to simplify the repayment process by only having one loan and one payment to worry about. Consolidation can also help to lower your monthly payments by extending the life of the repayment process from 10 years up to 30 years. Unfortunately, private loans are not eligible for consolidation.

I know paying back student loans can seem like a daunting challenge, but know that you are not alone. There are plenty of free resources out there to help you figure out the best method for paying loans off and over time you will become more comfortable with the process. Just remember to be organized, proactive, and responsible with your loans and you’ll be paying them off in no time (or in 10 years..but who’s counting anyways!?)

Using Trunk Club to Update My Spring/Summer Wardrobe

Using Trunk Club to Update My Spring/Summer Wardrobe 5 Tips For Styling a Simple Summer Dress

5 Tips For Styling a Simple Summer Dress 5 Ways to Style a Bandana

5 Ways to Style a Bandana 3 Different Ways to Curl Your Hair

3 Different Ways to Curl Your Hair How to Master the 5-Minute Makeup Routine

How to Master the 5-Minute Makeup Routine Amazon Beauty Buys Under $25

Amazon Beauty Buys Under $25 3 Ways to Make Your next Trip More Memorable

3 Ways to Make Your next Trip More Memorable Tips for Digital Spring Cleaning and Organizing

Tips for Digital Spring Cleaning and Organizing Color Trend: Marigold

Color Trend: Marigold Mental Health Update: The 3 Major Changes I Made to Get Out of Depression

Mental Health Update: The 3 Major Changes I Made to Get Out of Depression 5 Unexpected Ways to Unwind After Work

5 Unexpected Ways to Unwind After Work How to Know You’re in a Controlling Relationship

How to Know You’re in a Controlling Relationship 4 Questions I get Asked as a Professional Resume Writer

4 Questions I get Asked as a Professional Resume Writer How to Make Friends at Work

How to Make Friends at Work Getting Out of the ‘Busy’ Mindset

Getting Out of the ‘Busy’ Mindset Ask Amanda: How do I pursue the career I want without formal training?

Ask Amanda: How do I pursue the career I want without formal training? Ask Amanda: How Do I Find a Therapist?

Ask Amanda: How Do I Find a Therapist? Ask Amanda: How do I stop being jealous in my relationship?

Ask Amanda: How do I stop being jealous in my relationship?

Eden Milligan Says

Online courses are a great way of self-development for students. I read a lot of research about how students learn new information much more effectively if they do it on their own. Many college students use professional research proposal writing services for this. The most famous such service is the LINK. This is an easy way to buy the best education aid if you need it. The modern educational system does not use all the possibilities of technological development. This is a problem that requires global change.

rubydelong Says

Thank you for sharing your research. Do you want to know financial literacy basics? This is especially important for students, as you pointed out in the article. I can advise you to visit: https://fitmymoney.com/bad-credit-score/ It is a place where experienced writers share their knowledge with readers. The comments are allowed, and you can ask whatever you want. The education process can be easy and interesting with FitMyMoney.

Gig Worker Says

Thanks for the great article. If you want to learn more about loans and generally improve your financial literacy, you can visit our website! There is a lot of useful information there, you can also find out the terms of a student loan from us!

Emma Says

It’s never too late to learn and you can always pay more attention to it. The main thing is to study what can benefit you in life, and you can always transfer routine tasks to services like this https://domypaper.me/

Jana Zejbech Says

Good guide on managing your student loan repayments! From understanding the basics to exploring available options, this article covers it all in simple terms. By the way, if you’re also interested, there are some valuable insights about obtaining a free business loan in Mississippi https://www.gofundshop.com/usa/mississippi/

creativeper Says

The life of a student can be quite challenging, particularly when faced with an overwhelming amount of homework and limited time to complete it. Fortunately, there’s an option to seek assistance from legit https://edureviewer.com/resume/lets-eat-grandma-resume-review/ a service that provides valuable support in such situations.